Financial Advisory

We offer expert financial advisory services to a diverse client base on structured, project-based, and equity investments. Our extensive offering of financial modeling and project/investment advisory services equips our clients with the necessary tools and insights for making informed business and investment decisions.

Our Approach

Designing the Financial Model

The main tool supporting the analysis and scenario building for a financial appraisal lies into the design of a tailor-made financial model that is structured as a flexible and comprehensive project cash flow module.

The compartmentalization of the FM into individual modules helps in quickly adapting individual parts of the model at different stages in the project without hampering the overall product reliability and integrity. In other words, the FM is a living decision making tool across the project’s life

Forecasting and Analyzing the project cash flow

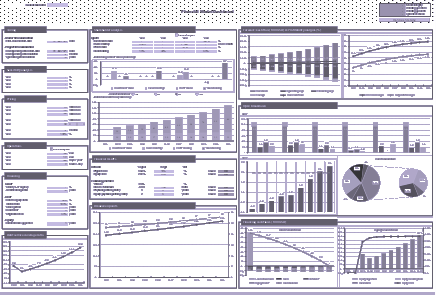

The first use of the FM is to test the viability of the project on the basis of its free cash flow (aka the aggregate of the operating and investment cash flows). The first step of this viability assessment is made in the project’s internal rate of return (IRR). This analysis provides an early indication of the project’s viability and the overall return it brings and can also shed light on necessary improvements and/or cost-cutting measures in case of a return that is lower than expected. The fact that this analysis can be done across several scenarios (identified by the technical and commercial teams) allows a quick filtering of the most feasible scenarios, before narrowing down the alternatives to the most realistic and viable. The starting point of this exercise, after all the relevant modules are completed, tested and fitted together, is the design of a powerful user interface, or dashboard, that acts as the sole user interface for using the FM. Projects at such an upstream stage require highly iterative models, considering a wide range of possible commercial scenarios and construction options, which requires the FM to be flexible enough to quickly balance multiple parameters. The combination of highly tailored model with simple VBA macros makes the tool user friendly to modellers and non-modellers alike.

As software alone cannot solve all the bottlenecks and naturally lacks commercial sense, tuning and designing the model and its optimisation mechanisms require a deep understanding of the underlying project, as well as its commercial and financial drivers. With the teams combined experience, critical features will be selected and shown on the dashboard to make the use of the model as easy and efficient as possible.

Identification of feasible scenarios and project viability

Comparison of input assumptions (demand, revenue, lifecycle costing and investments) lays down the foundation for the business case of the project. The analysis will be expanded beyond the project’s viability, into the assessment of bankability: whether the project can repay external financing and meet a hurdle rate for investors/sponsors, which will be the key metric in establishing the feasibility of the project.

Analysing the investor cash flow

The final element of the financial appraisal extends to evaluate the scenarios in ‘pure’ financial terms: by simulating the respective returns for investors, taking into account project’s financing structure. The model produces a set of selected key metrics: equity IRR, debt coverage rations, ability to repay external financing, etc.

Why Choose Us?

Contact Us-

Broad Financial Expertise

We bring in a wealth of experience and knowledge to the table, having served a wide range of sectors. We draw on our deep understanding of value and risk across various industries to provide state-of-the-art investment decision tools and insights to serve your particular needs.

-

Tailored Financial Solutions

We recognize the unique nature of each client’s situation and project’s characteristics. We design tailor-made solutions that inform your decision-making process and aligns with your objectives. Unlike the competition, our tools are delivered in a fully functional format free of any copyright restriction and limitation in use and time.

-

Collaborative Partnerships

We value strong partnerships with our clients that is fostered through open and transparent communication. We work closely with your team throughout the appraisal process, providing regular updates and ensuring all your concerns and adequately addressed.

Discover how our dynamic team of consultants can elevate your business to new heights. Contact us today to explore our full range of services and experience the power of innovation and expertise. Reach out to us for further information or to schedule a consultation